First time home buyer programs with poor credit

The first step to buying a home with bad credit is to save up for a down payment. Introducing a new 0 down payment program.

12 First Time Home Buyer Mistakes And How To Avoid Them Nerdwallet

We Help You Qualify For A Low Credit Loan Fast Fill Out The Form Below To Get Help Today.

. This is a popular government zero down home loan program that. Fannie Mae homes sell in as-is condition so you may have to repair a few things before your new place is move-in ready. Best for low or bad credit scores overall.

Many first-time homebuyer programs grants and down payment assistance programs are available to help you secure the financing you need to purchase your first. Best for FHA loans. Qualifying home buyers can use the VA loan program with 0 down so its a great option for first-time buyers.

They have competitive interest rates and offer a secure low-down-payment. Households with 3 percent down payment plus closing. Fannie Mae offers first-time home buyers the chance to buy a foreclosed property for as little as 3 down with their HomePath program.

New American Funding. Just note many VA loan lenders require a minimum score. Ad First Time Home Program Easy Process 100 Online Fast Approval Best Rates for 2022.

FHA Loans The FHA mortgage loan is very popular amongst first-time homebuyers. And the rates it charges for private mortgage insurance PMI are cheaper than for standard conventional. An FHA mortgage requires an upfront fee of 175 of the loan.

Best for first-time home buyers. If your credit score is between 500 and 579 youll need to put down at least 10. We can help you find bad credit home loan options by state and by city.

Ad Compare The Best Mortgage Lenders Find the Top First Time Home Buyer Programs Apply Now. A credit score which can in theory range from 300 to 850 of around 640 is usually sufficient to meet minimum credit score requirements for first-time home buyer assistance. 601-660-it is fair credit scores and the borrowers can repay the amount owed to the lenders on time.

The main concern most first-time homebuyers have is the down payment and closing costs. Ask about their special programs for home buying with past credit problems. Get a low credit score home loan A Federal Housing Administration loan is one option for prospective home buyers with poor credit as the FHA typically offers these.

501-600- It is a poor condition of the credit scores which explains poor credit condition. You can even apply for up to 3 of your closing costs back through the program as well. HUD requires a 35 down.

The down payment on a home purchase is fixed. The minimum credit score needed to get an FHA loan is 500. With a minimum credit score of 500 and 10 down thats 31090 for the Q3 2019 median home price you can qualify.

Borrowers can qualify for FHA Loans. Bank of America is moving forward with a 0 down payment mortgage program called the Community Affordable Loan Solution. However if you have a credit score of 580 or higher youll only be required to put down 35.

HomeReady requires only 3 down and a 620 credit score. FHA loan programs down payment assistance programs realtors and other first-time home-buying programs for people with low to moderate income. A down payment is the amount of money youll put towards the purchase of your.

Department of Housing and. - USDA Offers 100 loans on rural homes. If youre a first-time home buyer FHA loans can be very attractive because of lower qualifying requirements.

Common Mistakes That First Time Home Buyers Make Buying First Home First Time Home Buyers Home Buying Process

15 Best New Home Buying Books To Read In 2022 Bookauthority

5 Steps To Get A Loan As A First Time Home Buyer With Bad Credit Badcredit Org

How To Buy A House With Bad Credit In 2022 Tips And Tricks

Minimum Credit Scores For Fha Loans

Get A Mortgage With A Bad Credit Score Wowa Ca

First Time Home Buyer Tips Jd Pdx Real Estate

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

What Is A Credit Score Bayou Mortgage

Firsttimehomebuyer Explore Facebook

The 10 Most Popular First Time Homebuyer Programs

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

First Time Home Buyer Guide A Step By Step

0phn91f1e5lwcm

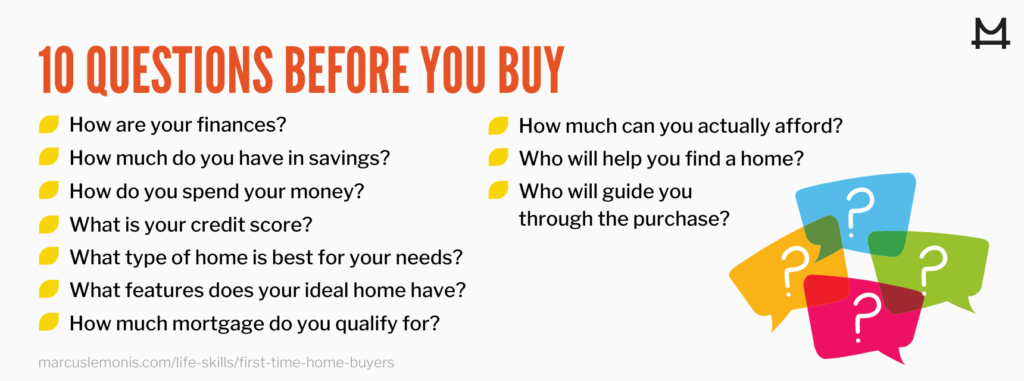

Tips For First Time Home Buyers What You Must Know Before You Buy

How To Buy A Home In Canada Guide For The First Time Home Buyer

Tips For First Time Home Buyers What You Must Know Before You Buy